Did you know that more than half of Americans don’t have a will?1 Did you also know that nearly 4% of Americans will die before they reach the age of 40?2 Pretty scary statistics. But when you’re young and in the prime of your life and just getting married and having babies, this is not a statistic that crosses your mind. You have so much life left ahead of you; you’re so young and in great health. Getting a will and buying life insurance can wait a while, right?

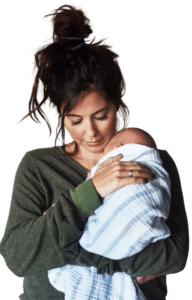

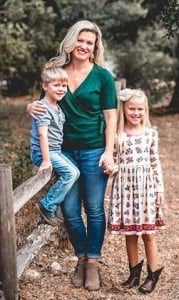

I thought that, too. And then, one night in October 2017, I woke up to a nightmare. I will spare you the details because I don’t want to relive it, but I lost my 36-year-old, perfectly healthy (as far as we knew) husband that night. In the blink of an eye, I became a widow with two small children. And we didn’t have wills or life insurance.

Do I have your attention now? Good. Because if it can happen to me, if it can happen to my husband, it can happen to you. I know wills, death, and all of this stuff is depressing and boring, but it’s so important. None of us are promised a tomorrow. None of us are promised a long and healthy life. And none of our children are promised to have two living parents to raise them. So you need to take the time to do what’s necessary now before it’s too late.

Essential Estate Planning Documents

These documents are the essentials for ensuring you and your assets are taken care of in the event of your death. You can hire an estate planning attorney to draw them up for you (an investment I highly encourage and recommend), or you can hire a service like Legal Zoom or Rocket Lawyer to create them.

- A Will — A will is a legally binding document that gives you control over what happens to your estate (and your minor children) in the event of your death. It makes managing your assets easier for those you’ve left behind.

- Medical Power of Attorney — This document allows the person you have chosen to make medical decisions on your behalf if you are unable to do so.

- Durable General Power of Attorney — This document appoints a person of your choosing to take care of financial matters when you are unable to do so.

- Living Will — Also called an “advanced health care directive,” allows you to very specifically express your desires for end-of-life medical treatment, such as being removed from life support.

Other Important Things to Consider:

Invest in life insurance.

Many people assume that life insurance is expensive, so they don’t purchase it. It is actually really affordable, and you should invest in it immediately. You can buy a decent life insurance policy starting as low as $20 a month. I can tell you from experience that not having life insurance is devastating for the family you could leave behind. Even a small policy will help your family afford any medical bills or funeral expenses, which are very expensive.

Talk to your spouse about how you want to be laid to rest.

Listen, I know how hard this conversation will be. My husband and I discussed whether we wanted to be cremated or buried, but I couldn’t remember what he said he wanted after he died. I wish we had written it down! Have this hard conversation with your spouse, but also sit and write it down together. Or write it separately if you don’t want to discuss it because it upsets you. Then take that document and include it with your will, or at the very least, put it in a safe place where you’ll know to look for it if the unexpected happens.

Keep your documents in a safe place.

Buy a small fireproof safe and keep it in a closet. Put your signed and notarized wills and other documents in that safe and leave them there. Or you can purchase a safety deposit box in a bank and keep them there. Whatever you choose, you want to ensure your documents remain intact should anything happen to your house. The last thing you want to happen to those crucial documents after you’ve gone through all the trouble of planning your estate is for all of it to go up in smoke.

Believe me; I know how uncomfortable a topic this is. I know how it can make even a grown man squirm to think about these things. But you have to. I can’t tell you more plainly than that. Never in a million years did I think that I would become a widow at 37 years old. But here I am. I have to deal with the grief of losing my husband and the grief of my children, but also the strenuous, stressful, and tedious task of handling my husband’s affairs without the benefit of a will. This is not a situation I would wish for anyone. So please, spend one weekend with your spouse and get these things done. I promise you it is worth the effort.